Payroll

Dakar specialises specifically in HR solutions, offering a vast range of products, all focused on Human Resources.

Payroll is Dakar’s flagship module.

It is not just a payroll; it is a software which integrates several modules that work directly from your web browser through a web-based software.

It is not just a payroll; it is a software which integrates several modules that work directly from your web browser through a web-based software.

It is important that employees are paid accurately and on-time, and that an organisation remains in compliance with legal and financial requirements.

Dakar Payroll connects you to all your employee-related information in ways no other solution can. It combines essential functionality with exclusive, high-impact extra features that are unique to Dakar, gained from over 30 years of experience in this dynamic industry.

Core Features

Dakar Payroll is a fully user-definable package offering functionality far beyond simple payroll production and reporting.

It can be integrated across all Dakar modules and refined to the shifting landscape that underpins people management. New fields, reports or commands can be created to address your specific needs. In short, Dakar Payroll grows hand-in-hand with your business and allows you to do things your way.

Calculating employee salaries, wages, bonuses and other forms of compensation

Employee Compensation

Calculation and deducting taxes, social security and other relevant taxes

Withholding Tax

Ensuring compliance with laws and tax regulations

Compliance

Maintaining records of employee information, payroll history, and tax filings

Record Keeping

Facilitating electronic transfer for employee payments

SEPA transfer

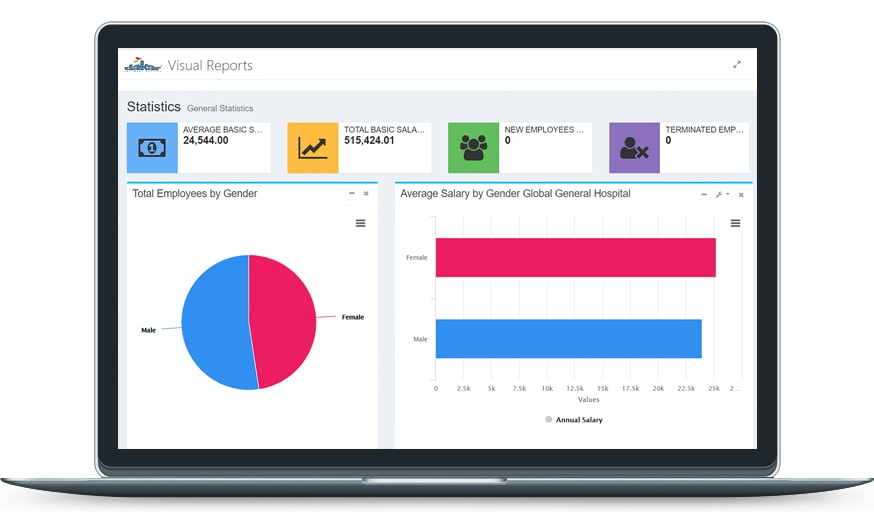

Generating reports for tax purposes and management insights

Reporting

Generation of government reports - Electronic Lodgements, FS3 and FS7 reports

Year-End Reports

Weekly, fortnightly,

4-weekly and Monthly

4-weekly and Monthly

Computation of any payroll frequency

Salary and Career progression

Historical Information

- Unlimited payments and deductions

- User-Defined Overtime computation rates (on weekends, public holidays, Sundays etc.)

- Payslip Printing and emailing

- Point-in-time historical

- “What-if” scenarios

- Budgeting

- Document Management

- User-defined payslip (on request)

- Direct Credits

- Electronic Lodgements

- Fringe Benefits

- Employee Schedule management

- Automatic backdated payroll calculations – collective agreements

- Net-to-Gross Salary Calculation (for Expats or for contracts on net pay basis)

- Payments into multiple employee bank accounts

- Loan Management

- Pension Scheme Management

- User-Defined audit and security features

- Payslip and FS3 (pre)views

- Compliant with all local legislation and employment requirements

- Bulk payroll adjustment imports

- Integration with Accounting packages and HR products

- Share options

Frequently Asked Questions

Explore our FAQ section for comprehensive insights and answers.

The system is updated according to all legislative changes except for the areas listed below. This is because companies have different procedures and may fall under different wage regulation order.

To re-calculate a past calculated payroll, you will need to unlock that pay period. Do this by going to Settings, then Unlock Payrolls choosinge the pay period you need to re-calculate.

This issue occurs if a payroll was re calculated and the FS5 was not re issued. Kindly make sure you have a copy of all the original FS5s submitted to the IRD, re-issue the FS5s and check which of the FS5s changed. Then simply re-issue the FS3s and FS7s. These should then match.

Go to the top menu on this website and click on Login: then Malta, then the Payroll year you wish to enter and then log in with your credentials for that year.

Keep In Touch

Stay connected with us by completing the form below. We look forward to hearing from you!